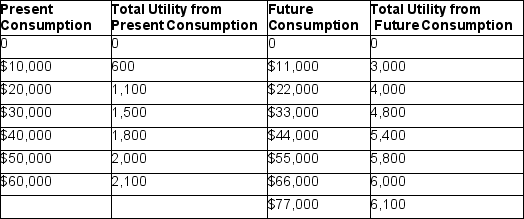

Mark's annual after tax income earnings are $50,000. His $40,000, 3-year CD is maturing in the near future and he is planning to spend the interest on a 6 week holiday after that. His investments can earn a total of 10% before he starts his trip. If Mark's "present consumption" is the time he spends working and his "future consumption" is his trip, his optimal choice from the table below is to:

A) spend $50,000 now and consume nothing in the future

B) spend nothing now and consume $77,000 in the future.

C) spend $10,000 now and consume $44,000 in the future.

D) spend $20,000 now and consume $33,000 in the future

Correct Answer:

Verified

Q43: Troy has a part-time job in a

Q44: Molly attends college and works part-time job

Q45: The _ budget constraint shows the tradeoff

Q46: Terry attends college and works part-time job

Q47: The theoretical model of the intertemporal budget

Q49: Even with wage increases, the supply curve

Q50: Bruce works for a large bank. His

Q51: The government distributes food stamps that can

Q52: Saving money is an) _, because it

Q53: Louisa works for a hedge fund company.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents