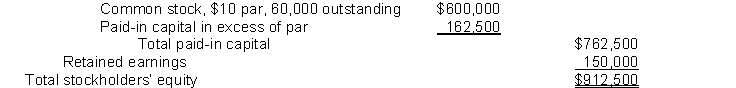

Giraldi Corporation's stockholders' equity section at December 31, 2013, appears below:

Stockholders' equity

Paid-in capital  On June 30, 2014, the board of directors of Giraldi Corporation declared a 15% stock dividend, payable on July 31, 2014, to stockholders of record on July 15, 2014. The fair value of Giraldi Corporation's stock on June 30, 2014, was $16.

On June 30, 2014, the board of directors of Giraldi Corporation declared a 15% stock dividend, payable on July 31, 2014, to stockholders of record on July 15, 2014. The fair value of Giraldi Corporation's stock on June 30, 2014, was $16.

On December 1, 2013, the board of directors declared a 2 for 1 stock split effective December 15, 2014. Giraldi Corporation's stock was selling for $18 on December 1, 2014, before the stock split was declared. Par value of the stock was adjusted. Net income for 2014 was $230,000 and there were no cash dividends declared.

Instructions

(a) Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split.

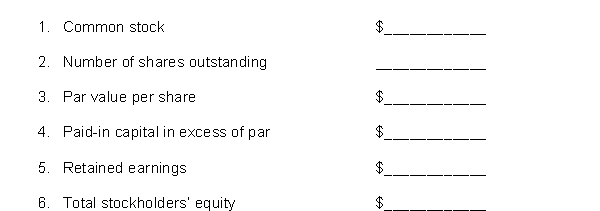

(b) Fill in the amount that would appear in the stockholders' equity section for Giraldi Corporation at December 31, 2014, for the following items:

Correct Answer:

Verified

Q224: The corporate charter of Torres Corporation allows

Q227: Listed below are items typically found in

Q229: On January 1, 2014, the Black Corporation

Q229: Lindy Corporation has 1,000,000 authorized shares of

Q230: During 2014 Kenton Corporation had the following

Q231: The following information is available for Epstein

Q233: The stockholders' equity section of Fleming Corporation

Q235: The following items were shown on the

Q236: Miles Co. had these transactions during the

Q237: The following accounts appear in the ledger

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents