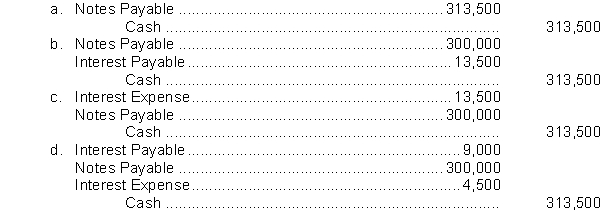

Moss County Bank agrees to lend the Sadowski Brick Company $300,000 on January 1. Sadowski Brick Company signs a $300,000, 6%, 9-month note. What entry will Sadowski Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

Correct Answer:

Verified

Q50: Current liabilities are due

A) but not receivable

Q68: The effective interest method produces a constant

Q71: Which of the following most likely would

Q77: Moss County Bank agrees to lend the

Q79: Failure to record a liability will probably

A)

Q80: Unearned Rent Revenue is

A) a contra account

Q83: The interest charged on a $70,000 note

Q87: The current portion of long-term debt should

A)

Q90: The interest charged on a $250,000 note

Q94: A company receives $261, of which $21

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents