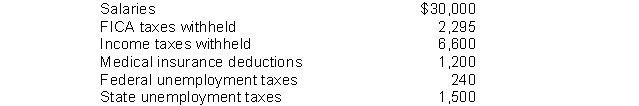

The following totals for the month of April were taken from the payroll records of Metz Company.  The entry to record accrual of employer's payroll taxes would include a

The entry to record accrual of employer's payroll taxes would include a

A) debit to Payroll Tax Expense for $4,035.

B) credit to Payroll Tax Expense for $4,035.

C) credit to FICA Taxes Payable for $1,740.

D) credit to Payroll Tax Expense for $1,740.

Correct Answer:

Verified

Q52: Interest expense on an interest-bearing note is

A)

Q75: Sales taxes collected by a retailer are

Q81: A retail store credited the Sales Revenue

Q98: The interest charged on a $70,000 note

Q100: The interest charged on a $250,000 note

Q103: Al's Bookstore has collected $750 in sales

Q104: Norlan Company does not ring up sales

Q106: The following totals for the month of

Q113: Keller Company issued a five-year interest-bearing note

Q115: Tina's Boutique has total receipts for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents