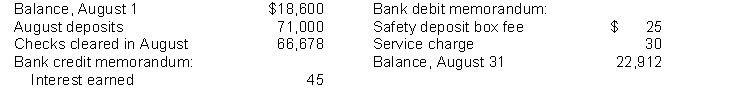

Lowe Inc.'s bank statement from Western Bank at August 31, 2014, gives the following information.  A summary of the Cash account in the ledger for August shows the following: balance, August 1, $21,100, receipts $81,000; disbursements $73,570; and balance, August 31, $28,530. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $7,000 and outstanding checks of $4,500. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40.

A summary of the Cash account in the ledger for August shows the following: balance, August 1, $21,100, receipts $81,000; disbursements $73,570; and balance, August 31, $28,530. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $7,000 and outstanding checks of $4,500. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40.

Instructions

(a) Determine deposits in transit.

(b) Determine outstanding checks.

(c) Prepare a bank reconciliation at August 31.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q154: Sarbanes Oxley applies to

A)U.S companies but not

Q162: Cash equivalents are defined by IFRS as

A)cash

Q163: IFRS, compared to GAAP, tends to be

Q164: Cash is defined by IFRS as

A)cash on

Q221: The cash records of Landis Company show

Q228: Holcomb Company expects to have a cash

Q240: The management of Morton Company estimates that

Q244: How do these principles apply to cash

Q248: A basic principle of cash management involves

Q256: One of your accounting professors has alerted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents