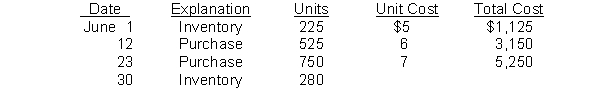

Johnson Company reports the following for the month of June.  (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why?

(c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q202: Wolf Camera Shop Inc. uses the lower-of-cost-or-market

Q203: Carter Company reported these income statement data

Q204: Wooderson Company sells many products. Gizmo is

Q205: Grother Company uses the periodic inventory method

Q206: This information is available for Groneman, Inc.

Q208: Compute the cost to be assigned to

Q209: Torrey Company uses the periodic inventory system

Q210: The following information is available from the

Q211: Hansen Company uses the periodic inventory method

Q212: Condensed income statements for Swift Corporation are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents