A review of the ledger of Wilde Co. at December 31, 2014, produces the following data pertaining to the preparation of annual adjusting entries:

(a) Salaries and Wages Payable $0: Salaries are paid every Friday for the current week. Five employees receive a weekly salary of $800, and three employees earn a weekly salary of $700. December 31 is a Tuesday. Employees do not work weekends. All employees worked the last 2 days of December.

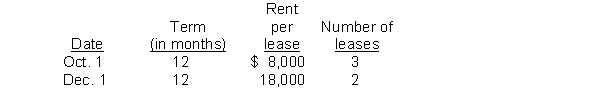

(b) Unearned Rent Revenue $58,000: The company had several lease contracts during the year as shown below:  (c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

(c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

Correct Answer:

Verified

Q242: On January 1, the Biddle & Biddle,

Q243: Better Publications, sold annual subscriptions to their

Q244: The balance sheets of Palle' Company include

Q245: On February 1, the Acts Tax Service

Q245: Hooper Company prepared the following income statement

Q248: A company using the cash basis of

Q249: The adjusted trial balance of Warbocks Corporation

Q251: A review of the ledger of Weakly

Q253: The adjusted trial balance of Warbocks Corporation

Q254: Match the statements below with the appropriate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents