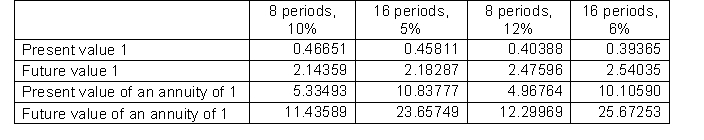

Chenard Company is about to issue $3,000,000 of 8-year bonds paying a 12% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Chenard uses to calculate compounded interest.  To the closest dollar, how much can Chenard expect to receive for the sale of these bonds?

To the closest dollar, how much can Chenard expect to receive for the sale of these bonds?

A) $3,193,390

B) $2,293,710

C) $3,325,130

D) $5,400,000

Correct Answer:

Verified

Q263: Travis Tucker invests $10,655.04 now for a

Q266: Glover Company is about to issue $3,000,000

Q269: Hale Corporation issues an 8%, 9-year mortgage

Q270: ischer Company has decided to begin accumulating

Q272: A $30,000, 8%, 10-year note payable that

Q273: avid Jones deposited $6,500 in an account

Q274: Potter Company has purchased a patent that

Q276: Mergenthaler Company has just purchased machinery that

Q280: When determining the proceeds received when issuing

Q283: Rhode Company is about to issue $4,000,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents