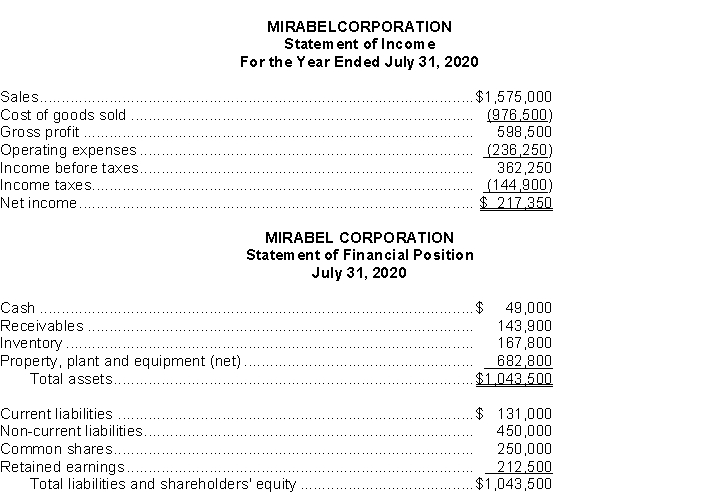

Mirabel Corporation's financial statements for 2020 follow:  Instructions

Instructions

a) If Mirabel were preparing common-size financial statements, calculate the following:

i. Cost of goods sold

ii. Operating expenses

iii. Net Income

b) Calculate the following liquidity ratios for Mirabel:

i. Current ratio

ii. Quick ratio

iii. Days Accounts receivable (assume average assets are the same as year-end assets)

iv. Days Inventory (assume average assets are the same as year-end assets)

c) Comment on Mirabel's performance.

Correct Answer:

Verified

i. Cost of goods sold (976,500 / 1,57...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: The return on assets ratio could be

Q74: To best interpret the accounts receivable turnover

Q80: The quick ratio will be negatively impacted

Q91: An analyst is comparing two companies, a

Q92: Which of the return on investment ratios

Q93: Which of the following depicts the quick

Q94: From the year-end financial statements of LuLu

Q97: Two companies have an identical amount of

Q98: Which ratio can help estimate the number

Q99: Lenders would be most concerned with

A) debt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents