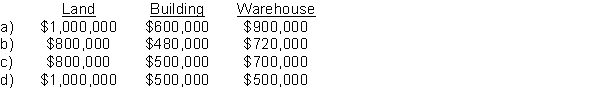

AFM Holdings Co. purchased 15 acres of land with an office building and warehouse on it for $2,000,000. The assets were appraised at: land $1,000,000, building $600,000, and warehouse $900,000. The assets were carried on the seller's books at: land $800,000, building $500,000, and warehouse $700,000. At what cost should the purchasing company record each of the assets?

Correct Answer:

Verified

Q25: The most commonly used method of depreciation

Q28: A machine was purchased for $125,500 during

Q31: If an asset generates revenues evenly over

Q32: A plot of land was purchased for

Q35: Which of the following depreciation methods calculates

Q37: A key reason that there are various

Q38: A company is depreciating a $1,000,000 building

Q38: According to accounting standards,the method of depreciation

Q39: The ultimate sales value of a long-term

Q41: To apply the units-of-activity method, all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents