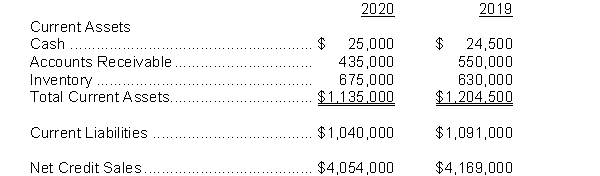

Triple H Enterprises Ltd. revealed the following information for the years ended December 31, 2020 and 2019:  Triple H Enterprise's credit terms are net 30 days.

Triple H Enterprise's credit terms are net 30 days.

Instructions

a) Calculate Triple H's 2020 and 2019 current ratio.

b) Calculate Triple H's quick ratio for 2020 and 2019.

c) Comment on Triple H's year over year liquidity position.

d) Calculate Triple H's accounts receivable turnover ratio for 2020.

e) On the average how long does it take Triple H to collect its accounts receivable? Is this good? If not, what types of things might Triple H consider in order to improve its collections?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: The quick ratio is also known as

A)working

Q108: Quick assets are

A)inventory plus cash and prepaid

Q109: A current ratio of 3:1 means

A)the company

Q116: Identify and describe the five limitations of

Q117: Nizzero Corporation is a newly created company

Q121: Describe the how accounts receivable is valued.

Q122: Briefly explain the two generally acceptable ways

Q123: A client who is an owner/operator of

Q124: Explain the main principles of internal control.

Q125: The following five items are usually considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents