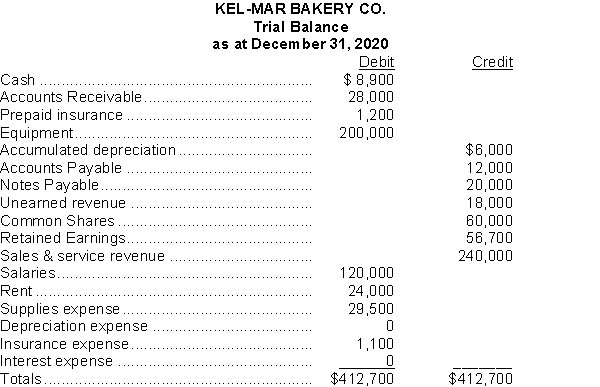

Shown below is the trial balance for Kel-Mar Bakery Co. as at December 31, 2020, the company's year end. The company owner provides you with the following additional information:

a) No interest has been paid yet on the note payable. The note has been outstanding since April 1 and the interest rate is 6%.

b) The equipment originally cost $200,000 and has an estimated residual value of $20,000 and a useful life of 6 years.

c) On June 1 the company renewed its insurance policy and paid a $1,200 premium for the year. It was correctly recorded at that time as prepaid insurance.

d) On October 1 the company sold a 12-month service contract to a client for $18,000 and recorded it as Unearned Revenue because at that point they had not yet provided any service to the client. They have been providing the service since the contract was sold.

Instructions

Prepare any adjusting entries required.

Correct Answer:

Verified

Q48: Which of the following statements about the

Q60: Which of the following is not an

Q61: Why is a trial balance prepared and

Q62: Given the following adjusted trial balance:

Q63: What are temporary accounts and why are

Q65: Shown below is an adjusted trial balance

Q66: What are T accounts and how does

Q67: Prepare year-end adjustments for the following transactions:

1.

Q68: The following is a summary of ledger

Q69: Sara Lee owns and operates Coffee and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents