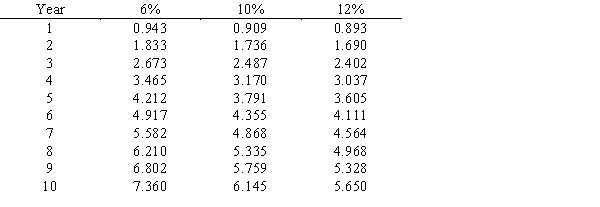

A project is estimated to cost $248,400 and provide annual net cash inflows of $50,000 for 8 years. Determine the internal rate of return for this project, using the following present value of an annuity table.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q143: What is capital investment analysis? Why are

Q166: A project is estimated to cost $273,840

Q167: Identify four capital investment evaluation methods discussed

Q168: BAM Co. is evaluating a project requiring

Q169: Proposals A and B each cost $600,000

Q171: Vanessa Company is evaluating a project requiring

Q172: A 6-year project is estimated to cost

Q173: Dickerson Co. is evaluating a project requiring

Q174: Determine the average rate of return for

Q175: Proposals L and K each cost $600,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents