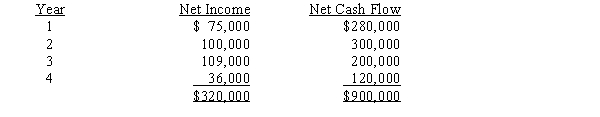

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:  The company's minimum desired rate of return is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

The company's minimum desired rate of return is 12%. The factors for the present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years are 0.893, 0.797, 0.712, and 0.636, respectively.Determine the net present value.

Correct Answer:

Verified

Q179: Jimmy Co. is considering a 12-year project

Q179: An 8-year project is estimated to cost

Q181: A $400,000 capital investment proposal has an

Q183: A $550,000 capital investment proposal has an

Q185: Norton Company is considering a project that

Q186: Sunrise Inc. is considering a capital investment

Q187: Briefly describe the time value of money.

Q187: Project A requires an original investment of

Q188: Project A requires an original investment of

Q189: The net present value has been computed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents