Snickett Corp. issued $5,000,000, five-year bonds on the first day of its fiscal year. The bonds have a stated rate of 11% and an effective (market) rate of 9%. Interest payments are made semiannually. Compute the following:

(a) The amount of cash proceeds from the sale of the bonds. Use the present value table and round to the nearest dollar.(b) The amount of premium to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar.(c) The amount of premium to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar.(d) The amount of the bond interest expense for the first year.

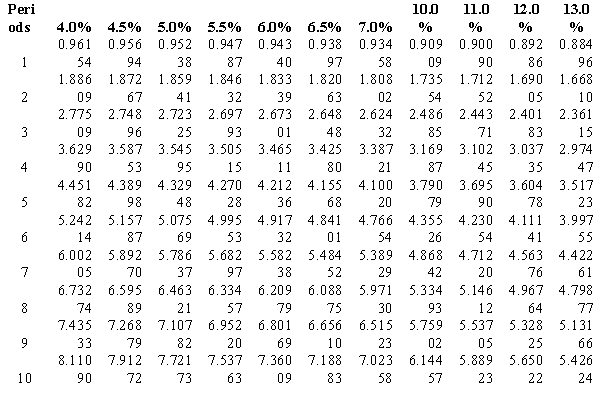

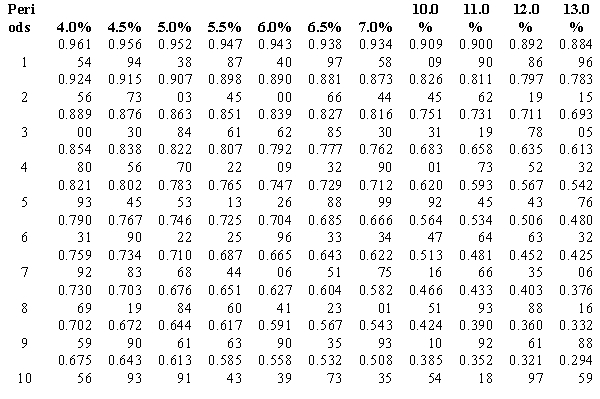

Present value of an annuity of $1 at compound interest:  Present value of a $1 at compound interest:

Present value of a $1 at compound interest:

Correct Answer:

Verified

(b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q153: A company issued $1,000,000 of 30-year, 8%

Q161: Marmalice Co. issued $4,000,000 of five-year, 10

Q163: Cramer Corp. issued $20,000,000 of 5-year, 9%

Q164: Using the following table, determine the present

Q166: Luke Corp. issued $2,000,000 of 20-year, 9%

Q167: A company issued $1,000,000 of 30-year, 8%

Q168: Cramer Corp. issued $20,000,000 of 5-year, 9%

Q169: If $1,000,000 of 8% bonds are issued

Q169: Assume you win a $1,000,000 contest, and

Q170: Luke Corp. issued $2,000,000 of 20-year, 9%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents