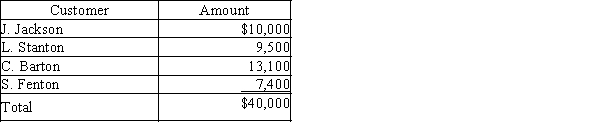

Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:  Required:

Required:

(a)Journalize the write-offs for the current year under the direct write-off method.(b)Journalize the write-offs for the current year under the allowance method. Also, journalize the adjusting entry for uncollectible receivables assuming the company made $2,400,000 of credit sales during the year and the industry average for uncollectible receivables is 1.50% of credit sales.(c)How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Correct Answer:

Verified

Q124: For each of the following scenarios, indicate

Q165: Discuss the (a) focus and

Q172: At the end of the current year,

Q175: Journalize the following transactions for Lucite Company.November

Q177: Fill in the blanks related to the

Q177: For each of the following notes receivable

Q181: The following information was taken from the

Q182: For the fiscal years 1 and 2,

Q183: Watson Company issued a 60-day, 8% note

Q184: Theta Company determines that a $6,300 account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents