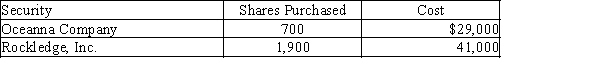

During the first year of operations, Makala Company purchased two trading investments as follows:  Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

(a)Prepare the current assets section of the balance sheet presentation for the trading securities as of December 31.(b)Explain how the gain or loss would be reported on the income statement.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: On February 12, Addison, Inc. purchased 6,000

Q103: The income statement for Hudson Company

Q110: The income statement for Dodson Corporation

Q118: Match each of the definitions that follow

Q122: Following are data for the trading securities

Q124: Prepare the journal entries for the following

Q125: Skyline, Inc. purchased a portfolio of trading

Q143: On March 1, Year 1, Chase Inc.

Q152: On August 1, Year 1, Ant Company

Q153: Discuss the appropriate financial treatment when an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents