Stella Gregson received a windfall from one of her investments. She would like to invest $100,000 of the money in Shoreline Industries, which is offering common stock, preferred stock, and bonds on the open market. The common stock has paid $8 per share in dividends for the past three years, and the company expects to be able to perform as well in the current year. The current market price of the common stock is $100 per share. The preferred stock has an 8% dividend rate, cumulative and nonparticipating. The bonds are selling at par with an 8% stated rate.

Required:

Required:

1. What are the advantages and disadvantages of each type of investment?

2. Recommend one type of investment over the others to Stella and justify your reason.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q171: Chad Jones established Jones' Cleaning Services, a

Q172: Assume that Milo Company's Stockholders' Equity category

Q173: Several transactions occurred for Shadow Dreams Corporation

Q174: Assume that on December 31, 2016, Potaw

Q175: On March 31, 2015, Outdoor Closets, Inc.

Q177: The following stockholders' equity section of Petal

Q178: Marvin's Shrimp Restaurant incorporated as a new

Q179: Information taken from the accounting records of

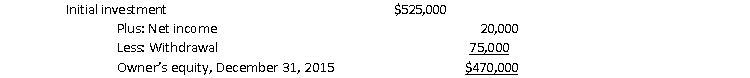

Q180: On December 31, 2015, Aire Dyne, Inc.

Q181: What are the advantages of organizing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents