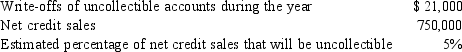

In its first year of business, Mariman Company has net income of $290,000, exclusive of any adjustment for bad debts expense. The president of the company has asked you to calculate net income under each of two alternatives of accounting for bad debts: the direct write-off method and the allowance method. The president would like to use the method that will result in the higher net income. So far, no adjustments have been made to write off uncollectible accounts or to estimate bad debts. The relevant data are as follows:

REQUIRED:

REQUIRED:

1. Compute net income under each of the two alternatives.

2. Does Mariman have a choice as to which method to use? If so, should it base its choice on which method will

result in the higher net income? Ignore income taxes. Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Cash flows from purchases,sales,and maturities of investments

Q147: Changes in accounts and notes receivable are

Q148: The process of assigning a note due

Q150: When an investor is able to secure

Q153: The length of time a note is

Q153: Refer to the data for Slammer Sports.

If

Q154: The amount of cash the maker is

Q161: Refer to the data for Slammer Sports.

Determine

Q162: Rafter.com received a 10%, 90-day promissory note

Q163: On August 16, 2015, Blenim Corp. purchases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents