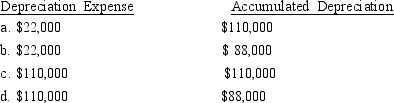

Grove Corp. purchased equipment at a cost of $260,000 in January, 2010. As of January 1, 2014, depreciation of $88,000 had been recorded on this asset. Depreciation expense for 2014 is $22,000. After the adjustments are recorded and posted at December 31, 2014, what are the balances for the Depreciation Expense and Accumulated Depreciation?

Correct Answer:

Verified

Q20: Cumberland City Consultants started business on January

Q21: Cuisine Company received a 6-month, 6% note

Q22: Expenses can be matched against revenue

A) If

Q22: On August 31, Farrell Corporation signed a

Q23: Expenses originate from

A) Using an asset or

Q27: Wentworth Company received advance payments from customers

Q30: Claxton Corp. purchased equipment at a cost

Q35: Mendes Company sells merchandise to customers.Mendes should

Q70: What effect does recognizing an accrued liability

Q84: Which one of the following is an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents