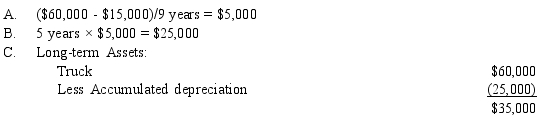

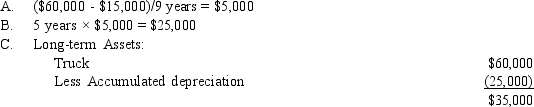

Carpenter Transport Company purchased a truck at a cost of $60,000 on January 1, 2011. The truck has an estimated useful life of 9 years and a $15,000 residual value.

A. How much depreciation expense should be reported for the year 2015?

B. What is the total amount of accumulated depreciation at December 31, 2015?

C. Show how the truck and the related accumulated depreciation would appear on Carpenter's December 31, 2015, balance sheet immediately after the adjustments are recorded and posted.

D. Is the amount on the balance sheet what the truck could probably be sold for on December 31, 2015? What principle governs?

E. How much depreciation expense should be reported for the year 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Adjusting entries are recorded at the end

Q33: When an expense is incurred prior to

Q142: Barker Corp. began operations on November 30,

Q147: Dino's Pizza employs 10 workers in its

Q148: Ramos Corporation employs 14 workers in its

Q166: According to the revenue recognition principle, revenues

Q168: Under the accrual basis of accounting, at

Q172: _ is the name given to balance

Q176: The _ principle attempts to associate with

Q180: The names of the four major types

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents