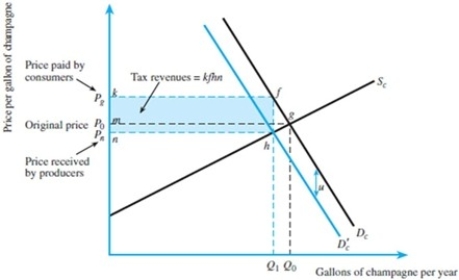

Refer to the figure below. Suppose the original before-tax demand curve for champagne is P = 100 - 2Qd. Suppose further that supply is P = 5 + 3Qs. Now suppose a $5 unit tax is imposed on consumers.

(A)What is the before-tax equilibrium price and quantity?

(A)What is the before-tax equilibrium price and quantity?

(B)What is the after-tax equilibrium price and quantity?

(C)How much tax revenue is raised?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: As long as firms are profit maximizing,

Q24: In the press,there has been a considerable

Q25: The economic incidence of a tax is

A)generally

Q26: In an open economy where capital is

Q28: General equilibrium analysis

A)finds equilibrium from general information.

B)examines

Q29: Suppose that demand is perfectly inelastic.Supply is

Q30: The ease with which capital can be

Q31: Examining how incidence differs when one tax

Q32: Statutory incidence of a tax deals with

A)the

Q33: When the ratio of taxes paid to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents