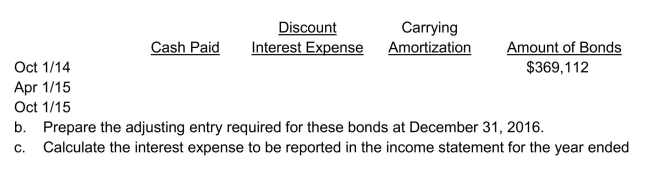

Bond interest and discount amortization On October 1, 2014, Irvine Corp.issued $400,000 8% bonds, due on October 1, 2019.Interest is to be paid semi-annually on April 1 and October 1.The bonds were sold to yield 10% effective annual interest.Irvine has a calendar year end. Instructions

a.Complete the following amortization schedule for the dates indicated.Round all answers to

the nearest dollar.Use the effective interest method.

December 31, 2016.

Correct Answer:

Verified

Q117: On January 2, 2014, Muslin Ltd.sold five

Q118: On January 1, 2014, Alvin Corp.sold property

Q119: Continental Company's 2014 financial statements contain the

Q120: Use the following information for questions. On

Q121: Accounting for a troubled debt restructuring On

Q123: On July 1, 2014, Pike Inc.issued $500,000,

Q124: On its December 31, 2014 statement of

Q125: Bond issue price and discount amortization On

Q126: Entries for bonds payable Long-Term Financial Liabilities

Q127: Pineapple owes Dole a $600,000, 12%, three-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents