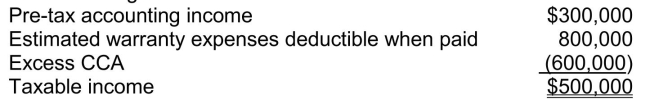

Future income taxes Nevada Corp., at the end of 2014, its first year of operations, prepared a reconciliation between pre-tax accounting income and taxable income as follows:  Estimated warranty expenses of $530,000 will be deductible in 2015, $200,000 in 2016, and $70,000 in 2017.The use of the depreciable assets will result in taxable amounts of $200,000 in each of the next three years. The enacted tax rate is 30% and is not expected to change. Instructions

Estimated warranty expenses of $530,000 will be deductible in 2015, $200,000 in 2016, and $70,000 in 2017.The use of the depreciable assets will result in taxable amounts of $200,000 in each of the next three years. The enacted tax rate is 30% and is not expected to change. Instructions

a.Prepare a schedule of the future taxable and deductible amounts.

b.Prepare the required adjusting journal entries to record income taxes for 2014.

Correct Answer:

Verified

Q41: Types of subsequent events

Identify the difference between

Q45: Segmented reporting (IFRS requirements)

A central issue in

Q54: Income taxes at interim dates

Discuss how income

Q79: Pension asset terminology

Discuss the following ideas related

Q240: Shareholders' Equity Indicate the effect of each

Q242: Approaches to accounting for pension expense Discuss

Q244: Taxable loss carryforward without valuation allowance (IFRS)

Q246: Interim reports A few years ago, a

Q247: Pension plan calculations and journal entries On

Q250: Stock dividends and stock splits Indicate the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents