A company expects to generate a $300,000 taxable income from its regular business operation in 2010. The

company purchased an industrial fork-lift for $75,000 at the beginning of year 2010. The company expects to

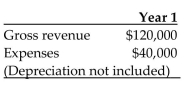

use it for the next 7 years after which it plans to sell it for $10,000. The estimated additional income and

expenses (excluding depreciation) with this purchase of lift-truck for the first year are given below. The fork-lift

will be depreciated according to a 5-year MACRS.  (a) Determine the average tax rate applicable in the first year of operation, using the current corporate tax rate

(a) Determine the average tax rate applicable in the first year of operation, using the current corporate tax rate

schedule.

(b) Determine the incremental tax rate that should be applied to the additional taxable income generated from

the purchase of the lift-truck.

Correct Answer:

Verified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents