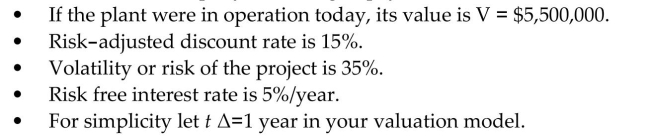

A Korean auto-part supplier is evaluating an investment project to build a manufacturing plant close to Kia

Automobile Assembly Plant near West Point, Georgia. The supplier can obtain a 1-year option to buy the

required parcel of land near West Point area and if the land is purchased the price would be $1,500,000. The

land option, if purchased, would expire 1-year from now. The supplier has two years to make a decision on

whether to build the plant and start operations, once the land was purchased. The required capital investment

would be $5,000,000. They estimate that the land, if purchased, could be sold for 110% of its purchase price

anytime over next two years.

What would the company be willing to pay for the combined value of the land option?

Correct Answer:

Verified

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents