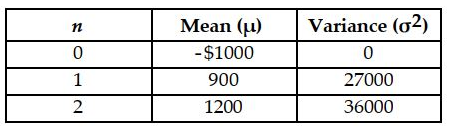

Assume a project is expected to produce the following cash flows in each year, each cash flow is independent of one another, each cash flow is gamma distributed, the risk-free rate is 5 % , and the MARR =15% .

(a) Calculate the expected net present value

(b) Calculate the standard deviation of the net present value

(c) Determine the probability that the NPV will be less than 600 .

(d) Determine the probability that the NPV will lie between 800 and 1200 .

Correct Answer:

Verified

Q1: Consider the following investment cash flows over

Q3: You are trying to analyze a risk-reward

Q4: As a marketing manager for a large

Q5: A new project will require $X in

Q6: An engineering editor for a large publishing

Q7: Langley Inc. has just invested $600,000 in

Q8: Barbara Thompson is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents