As a marketing manager for a large sports apparel manufacturer, you are trying to decide whether to open a

new factory outlet store, which would cost about $500,000. Success of the outlet store depends on demand in the

new region. If demand is high, you expect to gain $1 million per year; if average, $500,000; and if low, to lose

$80,000. From your knowledge of the region and your product, you feel the chances are 0.4 that sales will be

average, and equally likely that they will be high or low (0.3, respectively). Assume that the firm's MARR is

known to be 15%, and the marginal tax rate will be 40%. Also, assume that the salvage value of the store at the

end of 15 years will be about $100,000. The store will be depreciated under a 39-year property class.

(a) If the outlet store will be in business for 15 years, should you open the new outlet store? How much would

you be willing to pay to know the true state of nature?

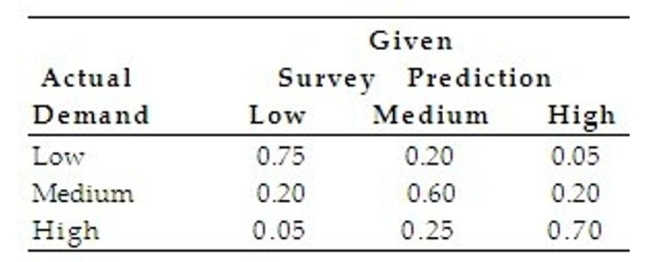

(b) Suppose a market survey is available at $1,000 with the following reliability (values obtained from past

experience where actual demand was compared with predictions made by the market survey).  Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute

Determine the strategy that maximizes the expected payoff after taking the market survey. In doing so, compute

the EVPI after taking the survey. What is the true worth of the sample information? Assume that you are a

risk-neutral person so that you are interested in maximizing the expected monetary value.

Correct Answer:

Verified

Q1: Consider the following investment cash flows over

Q2: Assume a project is expected to produce

Q3: You are trying to analyze a risk-reward

Q5: A new project will require $X in

Q6: An engineering editor for a large publishing

Q7: Langley Inc. has just invested $600,000 in

Q8: Barbara Thompson is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents