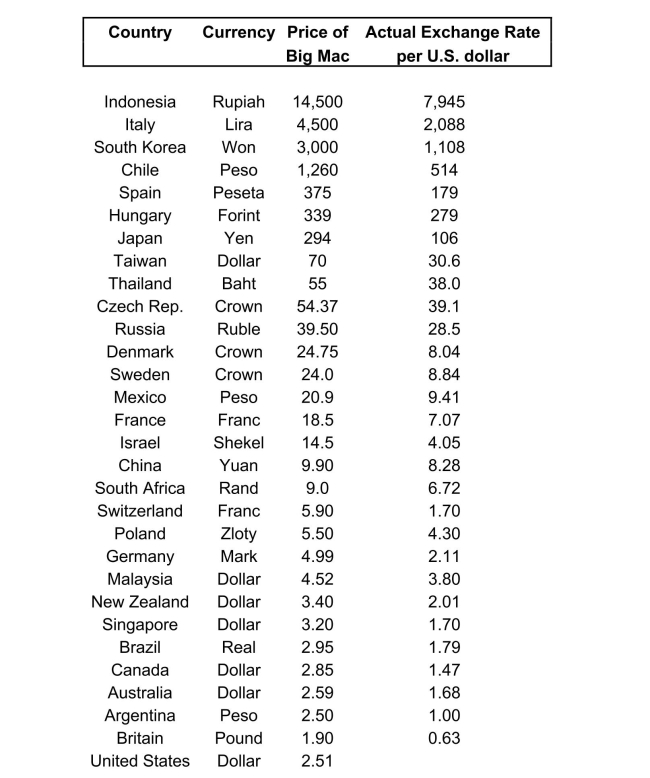

The news-magazine The Economist regularly publishes data on the so called Big Mac

index and exchange rates between countries.The data for 30 countries from the April 29,

2000 issue is listed below:  The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. a)Enter the data into your regression analysis program (EViews, Stata, Excel, SAS, etc.).

The concept of purchasing power parity or PPP ("the idea that similar foreign and domestic goods ... should have the same price in terms of the same currency," Abel, A. and B. Bernanke, Macroeconomics, edition, Boston: Addison Wesley, 476) suggests that the ratio of the Big Mac priced in the local currency to the U.S. dollar price should equal the exchange rate between the two countries. a)Enter the data into your regression analysis program (EViews, Stata, Excel, SAS, etc.).

Calculate the predicted exchange rate per U.S.dollar by dividing the price of a Big Mac

in local currency by the U.S.price of a Big Mac ($2.51).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The OLS estimator is derived by

A)connecting the

Q11: Interpreting the intercept in a sample regression

Q17: In the simple linear regression model, the

Q19: The standard error of the regression

Q20: The reason why estimators have a sampling

Q22: In order to calculate the regression

Q23: For the simple regression model of

Q24: In 2001, the Arizona Diamondbacks defeated

Q25: (Requires Appendix material) In deriving the

Q26: Prove that the regression

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents