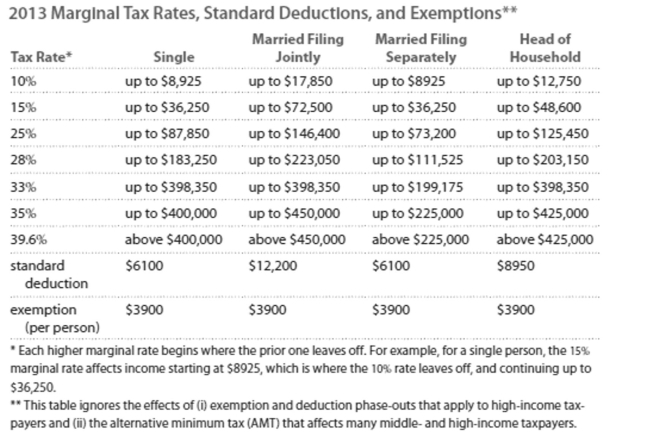

Solve the problem. Refer to the table if necessary.

-You are single and have a taxable income of $56,767. You make monthly contributions of $455 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred

Contribution.

A) Take-home pay will be $1365 more per year with tax-deferred plan

B) Take-home pay will be $1820 less per year with tax-deferred plan

C) Take-home pay will be $1820 more per year with tax-deferred plan

D) Take-home pay will be $1365 less per year with tax-deferred plan

Correct Answer:

Verified

Q42: Solve the problem.

-You need a $159,118

Q43: Decide whether the statement makes sense. Explain

Q44: Use the compound interest formula for compounding

Q45: Solve the problem.

-Suppose you start saving today

Q46: Find the annual percentage yield (APY).

-A bank

Q48: Use the compound interest formula for compounding

Q49: Answer the question.

-Many insurance companies carry a

Q50: Decide whether the statement makes sense. Explain

Q51: Compute the total and annual returns

Q52: Decide whether the statement makes sense. Explain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents