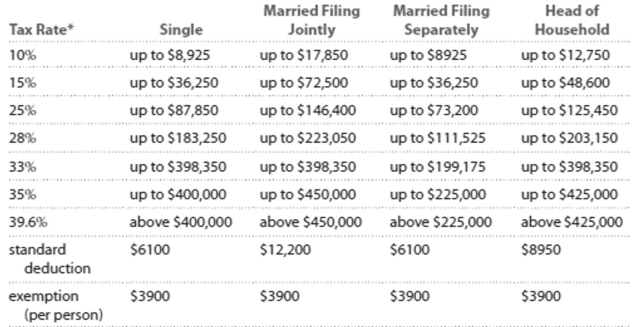

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Kevin is married, but he and his wife filed separately. His gross salary was $37,967, and he earned $448 in interest. He had $1141 in itemized deductions and claimed three exemptions for himself

And two children. Find his taxable income.

A) $27,274

B) $28,415

C) $19,474

D) $20,615

Correct Answer:

Verified

Q57: Decide whether the statement makes sense. Explain

Q58: Solve the problem.

-Budget Summary for the

Q59: Provide an appropriate response.

-A full-service broker offers

Q60: Provide an appropriate response.

-A(n)_ deduction is the

Q61: Solve.

-Mike and Carrie are in the

Q63: Solve the problem. Refer to the

Q64: Determine whether the spending pattern described is

Q65: Solve the problem. Q66: Solve the equation for the unknown. Q67: Use the given stock table to answer

-

-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents