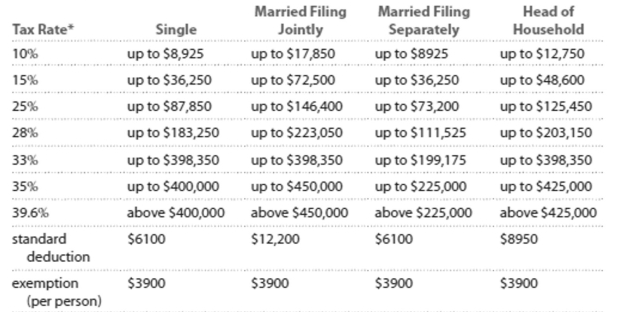

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Stephen earned $62,292 from wages as an accountant and made $2987 in interest. Find how much he paid in FICA and income taxes. Assume he is single and takes the standard deduction.

A) $14,723

B) $18,585

C) $14,514

D) $14,023

Correct Answer:

Verified

Q68: Solve the problem. Refer to the

Q69: Prorate the given expenses to find the

Q70: Provide an appropriate response.

-Early in an installment

Q71: Assume you have a balance of $3200

Q72: Calculate the amount of interest you'll have

Q74: Find the annual percentage yield (APY).

-A

Q75: Compute the total and annual returns

Q76: Solve the problem.

-You have a choice

Q77: Solve the equation for the unknown.

-

Q78: Solve the equation for the unknown.

-

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents