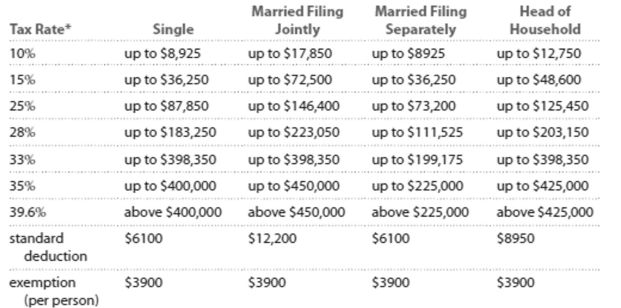

Solve the problem. Refer to the table if necessary.

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Tom and Toni are married and file jointly. Their combined wages were $78,148. They earned a net of $1593 from a rental property they own, and they received $1665 in interest. They claimed four

Exemptions for themselves and two children. They contributed $3364 to their tax-deferred

Retirement plans, and their itemized deductions total $10,516. Find their taxable income.

A) $62,442

B) $49,342

C) $56,070

D) $51,926

Correct Answer:

Verified

Q58: Solve the problem.

-Budget Summary for the

Q59: Provide an appropriate response.

-A full-service broker offers

Q60: Provide an appropriate response.

-A(n)_ deduction is the

Q61: Solve.

-Mike and Carrie are in the

Q62: Solve the problem. Refer to the

Q64: Determine whether the spending pattern described is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents