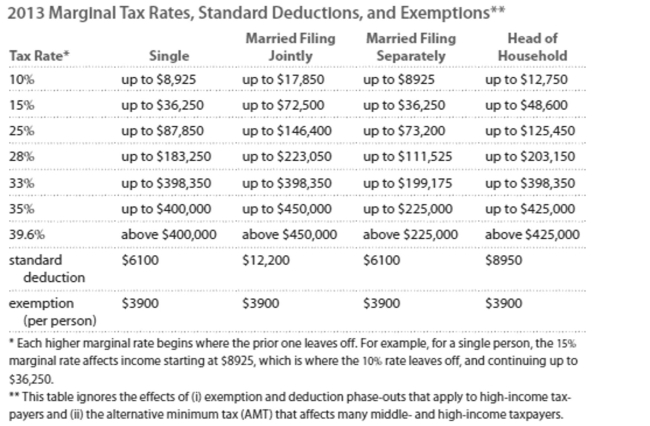

Solve the problem. Refer to the table if necessary.

-John is married filing separately with taxable income of $141,766. Calculate the amount of tax owed.

A) $32,520

B) $41,207

C) $34,939

D) $33,427

Correct Answer:

Verified

Q93: Solve.

-Denise is in the 35% tax bracket

Q94: Solve the problem.

-You want to have a

Q95: Calculate the balance under the given assumptions.

-Find

Q96: Solve.

-Tim is in the 35% marginal tax

Q97: Evaluate or simplify the following the

Q99: Solve the problem.

-You need a loan of

Q100: Solve the problem.

-The average cost of a

Q101: Provide an appropriate response.

-The average annual percentage

Q102: Evaluate or simplify the following the

Q103: Solve the problem. Refer to the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents