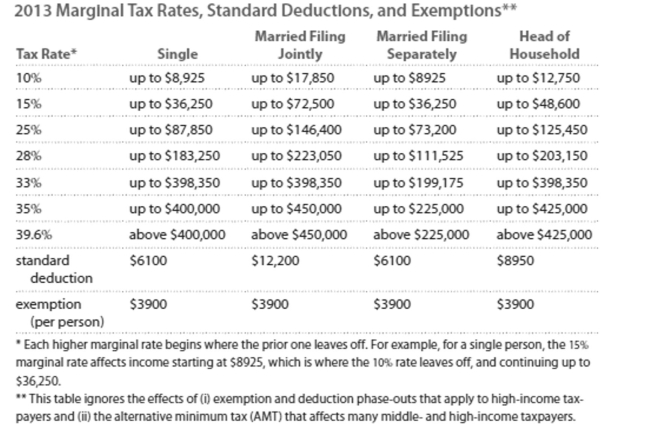

Solve the problem. Refer to the table if necessary.

-Jim earned wages of $89,118, received $5002 in interest from a savings account, and contributed $ 6342 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $8797. Find his adjusted gross income.

A) $75,081

B) $83,878

C) $100,462

D) $87,778

Correct Answer:

Verified

Q138: Provide an appropriate response.

-A _ gives you

Q139: Find the annual percentage yield (APY).

-A bank

Q140: Solve the equation for the unknown.

-

Q141: Solve the equation for the unknown

Q142: Answer the question.

-You have a choice between

Q144: Solve the problem.

-You have money in an

Q145: Solve the problem.

-Budget Summary for the

Q146: Solve.

-You are in the 25% tax bracket.

Q147: Use the compound interest formula for compounding

Q148: Solve the problem. Refer to the table

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents