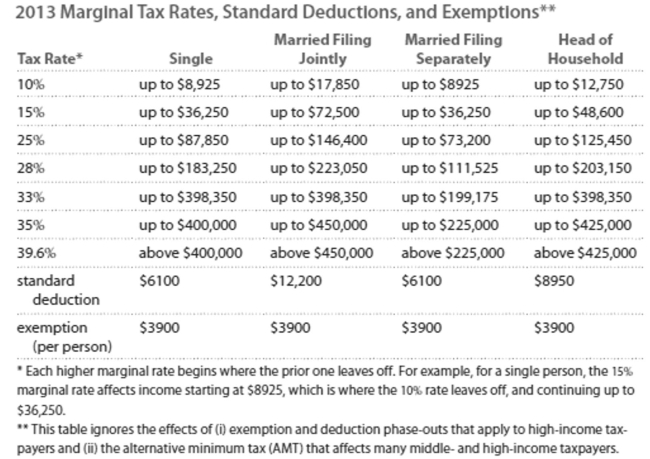

Solve the problem. Refer to the table if necessary.

-Kelsey earned $65,208 in wages. Conner earned $65,208, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

A) Kelsey: 0.0%

B) Kelsey: 22.6%

C) Kelsey: 21.4%

D) Kelsey: 14.9% Conner: 7.3% Conner: 4.4% Conner: 12.0% Conner: 4.4%

Correct Answer:

Verified

Q186: Provide an appropriate response.

-A savings plan in

Q187: Solve the problem. Refer to the table

Q188: Solve the equation for the unknown

Q189: Solve the problem.

-In a recent year, the

Q190: Answer the question.

-Stephen sets up an IRA

Q192: Solve the problem. Refer to the table

Q193: Use the compound interest formula to determine

Q194: Solve the equation for the unknown.

-

Q195: Solve the problem.

-$5832 is deposited into a

Q196: Use the compound interest formula to determine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents