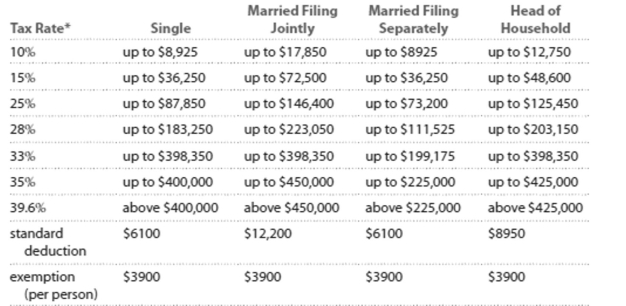

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Abbey earned $70,218 in wages. Kathryn earned $70,218, all in dividends and long-term capital gains. Calculate the total tax owed by each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

A) Abbey:

Kathryn:

B) Abbey: \$10,983

Kathryn:

C) Abbey:

Kathryn:

D) Abbey:

Kathryn:

Correct Answer:

Verified

Q234: Use the compound interest formula for

Q235: Answer the question.

-Suppose you are 25 years

Q236: Provide an appropriate response.

-If net income is

Q237: Use the given stock table to answer

Q238: Provide an appropriate response.

-There is high risk

Q240: Solve the problem. Refer to the

Q241: Solve the equation for the unknown

Q242: Solve.

-Calculate the monthly payment for a student

Q243: Provide an appropriate response.

-_, or income, represent

Q244: Provide an appropriate response.

-A _ represents a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents