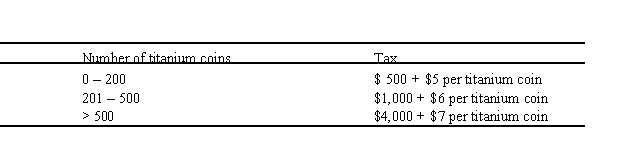

The mythical country of Januvia imposes a tax based on the number of titanium coins each taxpayer owns at the end of each year per the following schedule:  Marvin, a resident of Januvia, owns 300 titanium coins at the end of the current year. I. Marvin's titanium coins tax is $2,800. II. Marvin's marginal tax rate is $6. III. Marvin's average tax rate is $9.33. IV. Marvin's average tax rate is $6.

Marvin, a resident of Januvia, owns 300 titanium coins at the end of the current year. I. Marvin's titanium coins tax is $2,800. II. Marvin's marginal tax rate is $6. III. Marvin's average tax rate is $9.33. IV. Marvin's average tax rate is $6.

A) Statements II and III are correct.

B) Statements I, II, and IV are correct.

C) Statements II and IV are correct.

D) Statements I, II and III are correct.

E) Only statement II is correct.

Correct Answer:

Verified

Q21: Frank and Fran are married and have

Q24: Which of the following are included among

Q26: Which of the following statement is/are included

Q28: Adam Smith's concept of vertical equity is

Q29: Jim and Anna are married and have

Q31: Vertical equity I. means that those taxpayers

Q32: When planning for an investment that will

Q36: Which of Adam Smith's requirements for a

Q37: Jaun plans to give $5,000 to the

Q38: Which of the following payments meets the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents