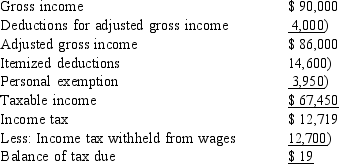

Betty is a single individual. In 2014, she receives $5,000 of tax-exempt income in addition to her salary and other investment income. Betty's 2014 tax return showed the following information:  Which of the following statements concerning Betty's tax rates is are) correct? I. Betty's average tax rate is 18.9%. II. Betty's average tax rate is 17.6%. III. Betty's effective tax rate is 18.9%. IV. Betty's effective tax rate is 17.6%.

Which of the following statements concerning Betty's tax rates is are) correct? I. Betty's average tax rate is 18.9%. II. Betty's average tax rate is 17.6%. III. Betty's effective tax rate is 18.9%. IV. Betty's effective tax rate is 17.6%.

A) Statements I and III are correct.

B) Statements I and IV are correct.

C) Statements II and III are correct.

D) Statements II and IV are correct.

Correct Answer:

Verified

Q41: A state sales tax levied on all

Q42: Oliver pays sales tax of $7.20 on

Q43: Elrod is an employee of Gomez Inc.

Q44: Sally is a single individual. In 2014,

Q45: Marie earns $80,000 as a sales manager

Q46: A tax provision has been discussed that

Q47: Katarina, a single taxpayer, has total income

Q50: The mythical country of Traviola imposes a

Q51: Shara's 2014 taxable income is $42,000 before

Q53: The mythical country of Woodland imposes two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents