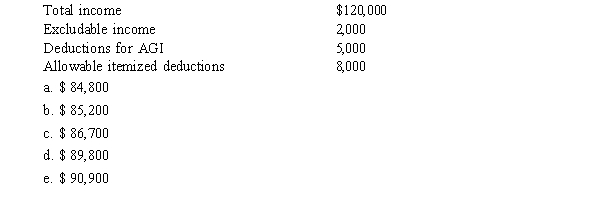

Based on the following information, what is the 2014 taxable income for a married couple with two children?

Correct Answer:

Verified

Q81: Tax planning involves the timing of income

Q82: Which of the following is/are categorized as

Q85: Tax evasion usually involves certain elements. Which

Q87: Carolyn and Craig are married. They have

Q90: For 2014, Nigel and Lola, married taxpayers

Q91: Tax planning involves the timing of income

Q94: Alice is a plumber and collector of

Q98: Tax planning involves the timing of income

Q102: Betty hires Sam to prepare her federal

Q111: Betty hires Sam to prepare her federal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents