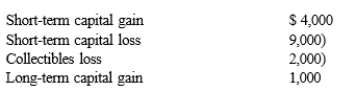

Andy has the following capital gains and losses during the current year:  Andy's capital gains and losses will

Andy's capital gains and losses will

A) Increase taxable income by $2,000.

B) Decrease taxable income by $6,000.

C) Decrease taxable income by $3,000.

D) Decrease taxable income by $4,000.

Correct Answer:

Verified

Q105: Ronald, a single taxpayer, purchased 300 shares

Q106: Dunbar, a single taxpayer, purchased 300 shares

Q106: Under the deferral method of accounting for

Q107: Ellie has the following capital gains and

Q108: Willis is a cash basis taxpayer who

Q109: Brandon is the operator and owner of

Q111: Chicago Cleaning Services provides nightly janitorial services

Q112: Alan has the following capital gains and

Q114: Franco is owner and operator of a

Q115: Angelica has the following capital gains and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents