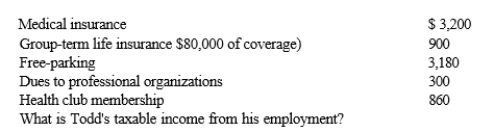

Todd, age 26 and single, is an employee of the Ice Corporation. Todd's annual salary is $50,000. Ice has a qualified pension into which employees may contribute 5% of their annual salary Todd contributes the maximum). The corporation also offers employees a flexible benefits plan. Todd pays $500 into the plan and is reimbursed for $500 of medical expenses not covered by his medical insurance. Ice also provides Todd with the following benefits:

Correct Answer:

Verified

Q87: David owes $120,000 to Second National Bank.

Q113: Benton leases a Park City condominium from

Q118: Explain why the taxpayer in each of

Q120: Eduardo and Ana Maria own their home,

Q123: Summary Problem: Ralph, age 44, is an

Q125: Carson, age 34 and single, is an

Q126: Graham and Lucy purchased their home in

Q142: Simon Leasing, Inc., an accrual basis taxpayer,

Q147: What are the differences between a cafeteria

Q150: Darren is a single individual who worked

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents