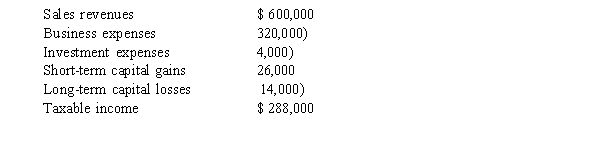

Teresa, Terri, and Tricia operate Sassy Solutions, an exclusive boutique. Based on advice from Teresa's sister, a CPA, the three form a partnership. Teresa owns 50% and Terri and Tricia each own 25%. For the year, Sassy Solutions reports the following:  For tax purposes, what amount will Sassy Solutions report to Teresa as her ordinary income from the partnership?

For tax purposes, what amount will Sassy Solutions report to Teresa as her ordinary income from the partnership?

A) $144,000

B) $146,000

C) $148,000

D) $138,000

E) $140,000

Correct Answer:

Verified

Q1: Evelyn can avoid the 2 percent limitation

Q3: John decides rather than work late in

Q5: Ona is a professional musician. She prepared

Q6: For a taxpayer to be engaged in

Q8: In order to take a business deduction,

Q9: A necessary expense is one that is

Q11: An individual is indifferent whether an expense

Q12: Andy lives in New York and rents

Q13: A taxpayer can take a deduction for

Q20: In order for a taxpayer to reduce

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents