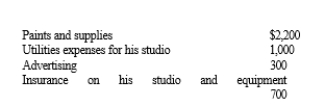

Mario paints landscape portraits, and he treats the activity as a hobby. During the current year, Mario incurred the following expenses while earning $2,500 from sales of paintings:  Mario uses the standard deduction and never itemizes his deductions. How should Mario report all of the items related to his hobby on his tax return?

Mario uses the standard deduction and never itemizes his deductions. How should Mario report all of the items related to his hobby on his tax return?

A) Hobby losses are not allowed so he couldn't deduct anything whether or not he itemizes anyway.

B) Report a $400 loss as a deduction for AGI.

C) Include $2,500 in gross income and deduct $2,500 for AGI.

D) Include $2,500 in gross income and deduct nothing for AGI.

E) Include $2,500 in gross income and deduct $1,700 for studio expenses.

Correct Answer:

Verified

Q84: Jack and Cheryl own a cabin near

Q84: Karen owns a vacation home in Door

Q86: James rents his vacation home for 30

Q88: Claire and Harry own a house on

Q89: Elise is a self-employed business consultant who

Q89: Mike and Pam own a cabin near

Q91: Generally income tax accounting methods are designed

Q91: Girardo owns a condominium in Key West.

Q98: Frank is a self-employed architect who maintains

Q100: Generally income tax accounting methods are designed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents