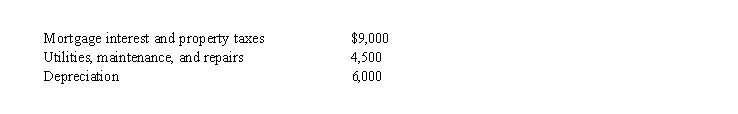

Marlene is a single taxpayer with an adjusted gross income of $140,000. In addition to her personal residence, Marlene owns a ski cabin in Vail. She uses the cabin for 40 days during the current year and rents it out to unrelated parties for 80 days, receiving rent of $10,000. Marlene's costs before any allocation related to the cabin are as follows:  Based on the above information, what is her allowable depreciation deduction?

Based on the above information, what is her allowable depreciation deduction?

A) $ - 0 -

B) $1,000

C) $3,000

D) $4,000

E) $6,000

Correct Answer:

Verified

Q46: Which of the following can be deducted

Q65: Several factors are used to determine whether

Q67: Walter pays a financial adviser $2,100 to

Q78: Virginia, a practicing CPA, receives $11,000 from

Q80: Chelsea operates an illegal gambling enterprise out

Q84: Karen owns a vacation home in Door

Q84: Jack and Cheryl own a cabin near

Q86: James rents his vacation home for 30

Q89: Elise is a self-employed business consultant who

Q91: Generally income tax accounting methods are designed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents