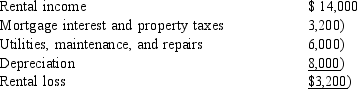

Landis is a single taxpayer with an adjusted gross income of $280,000. In addition to his personal residence, Landis owns a vacation home in Beaver Creek, Colorado. He uses the vacation home for 21 days during the current year and rents it out to unrelated parties for 63 days. After making the appropriate allocation between rental and personal use, the following rental loss is determined:  What is the correct reporting of the rental income and expenses? I. Because the rental shows a loss, Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction. II. Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses. III. Landis's depreciation deduction is limited to $4,800. IV. Because the vacation home is a qualified second residence, Landis can deduct the $1,600 loss for adjusted gross income.

What is the correct reporting of the rental income and expenses? I. Because the rental shows a loss, Landis reports no income and deducts the mortgage interest and property taxes as an itemized deduction. II. Landis must report the $14,000 in rental income but he can deduct only $14,000 of the expenses. III. Landis's depreciation deduction is limited to $4,800. IV. Because the vacation home is a qualified second residence, Landis can deduct the $1,600 loss for adjusted gross income.

A) Only statement II is correct.

B) Only statement IV is correct.

C) Only statement I is correct.

D) Statements II and III are correct.

E) Statements II and IV are correct.

Correct Answer:

Verified

Q82: Michelle is a bank president and a

Q82: Jim operates a business out of his

Q86: Generally income tax accounting methods are designed

Q91: Girardo owns a condominium in Key West.

Q93: Safina is a high school teacher. She

Q96: Tom and RoseMary own a cabin near

Q97: In which of the following independent situations

Q98: Frank is a self-employed architect who maintains

Q98: William, a single taxpayer, has $3,500 state

Q100: Generally income tax accounting methods are designed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents