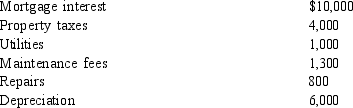

Wilson owns a condominium in Gatlinburg, Tennessee. During the current year, she incurs the following expenses before allocation related to the property:

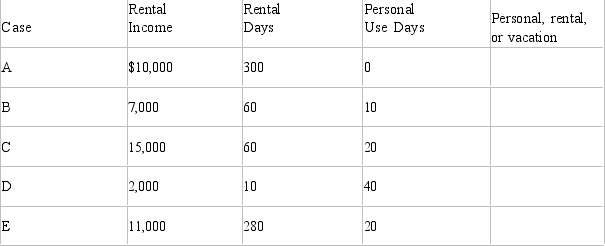

a. For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property, a rental or a vacation home.

b. Consider Case C. Determine Wilson's deductions related to the condominium. Indicate the

amount of each expense that can be deducted and how it would be deducted.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: An accrual basis taxpayer may deduct expenses

Q105: Indicate which of the following statements is/are

Q118: Janine, a cash-basis taxpayer, borrowed $15,000 for

Q122: Discuss whether the following persons are currently

Q124: Harold is a 90% owner of National

Q126: Discuss whether the following expenditures meet the

Q136: Income tax accounting methods and financial accounting

Q154: Larry is a history teacher. He subscribes

Q162: Using the general tests for deductibility, explain

Q166: Explain the rationale for disallowing the deduction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents