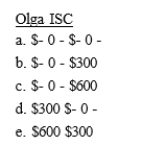

Olga is a technical sales consultant for Interactive Systems Corporation ISC) based in San Diego. While on business in Boise, she entertains several clients at a cost of $600. When she returns to San Diego, Olga gives ISC receipts and other information to account for the entertainment expense. ISC reimburses Olga $600. How much can Olga and ISC deduct?

Correct Answer:

Verified

Q1: Business and nonbusiness bad debts are both

Q2: The Crown Howe Accounting firm rents a

Q2: The Big Easy Company leases a luxury

Q7: Larry is a self-employed insurance salesperson. He

Q14: To be deductible,meals and entertainment must be

Q16: After negotiating a new supply contract with

Q17: Discovery, Inc., a cash-basis consulting firm, can

Q17: For moving expenses to be deductible the

Q18: A taxpayer may use either the actual

Q19: To be deductible, employee compensation must be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents