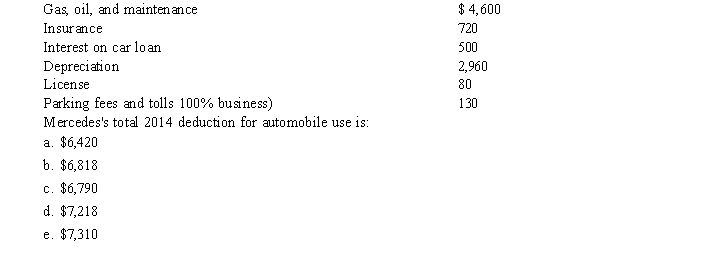

Mercedes is an employee of MWH company and drives her car 12,000 miles a year for business and 3,000 miles a year for commuting and personal use. She is not reimbursed by her employer. She wants to claim the largest tax deduction possible for business use of her car, before any limitations on itemized deductions. Her total auto expenses for 2014 are as follows:

Correct Answer:

Verified

Q23: Penny owns her own business and drives

Q25: Alfred uses his personal automobile in his

Q26: Rodrigo works as a salesperson for a

Q27: Sandra, who owns a small accounting firm,

Q30: Donna is an audit supervisor with the

Q32: In 2014, Eileen, a self-employed nurse, drives

Q33: Julie travels to Mobile to meet with

Q34: Ernest went to Boston to negotiate several

Q36: Carter is a podiatrist in Minneapolis. He

Q37: Caroline is a doctor in Little Rock.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents