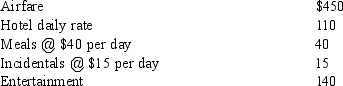

Arlene, a criminal defense attorney inherits $500,000 from her grandmother. Unsure of how to invest the money, Arlene attends a three-day investment seminar in New York. Arlene attends all the sessions and receives a certificate for successfully completing the seminar. Her expenses to attend the seminar are as follows:  What amount may she deduct as travel expenses for the seminar?

What amount may she deduct as travel expenses for the seminar?

A) $- 0 -

B) $780

C) $825

D) $885

E) $955

Correct Answer:

Verified

Q28: Carlotta pays $190 to fly from Santa

Q34: During 2014, Marsha, an employee of G&H

Q36: During 2014, Jason travels to Miami to

Q37: Walker, an employee of Lakeview Corporation, drives

Q38: Lester uses his personal automobile in his

Q42: Peter, proprietor of Peter's Easy Loan Company,

Q43: Which of the following taxpayers can claim

Q45: Three years ago Edna loaned Carol $80,000

Q53: Entertainment,auto,travel,and gift expenses are subject to strict

Q55: Francine operates an advertising agency. To show

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents